st louis county personal property tax rate

In Person and Drop Box Locations. Louis County collects on average 125 of a propertys assessed fair market value as property tax.

County Assessor St Louis County Website

Rates in Missouri vary significantly depending on where you live though.

. Louis County Auditor St. Its quick and easy. Obtaining a property tax receipt or waiver.

The Assessor together with his team of professional appraisers analysts and managers is required by Missouri law to calculate the market value of real property and business personal property. The median property tax on a 17930000 house is 163163 in Missouri. If you are a new Missouri resident or this is your first time filing a declaration in St.

While property values listed on the assessment. 2022 Individual Personal Property Declarations are in the mail and are due by June 30th 2022. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years.

You can pay your current year and past years as well. The states average effective property tax rate is 093 somewhat lower than the national average of 107. How to Calculate Property Taxes.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in St. Louis County is asking people who live there to avoid the lines and pay online. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

Duties of the Assessor. This is your first vehicle. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov.

Pay your personal property taxes online. For personal property it is determined each January 1. Your 2021 personal property and real estate taxes will start arriving in the mail soon.

W Room 214 Duluth MN 55802-1293. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. Assessor - Personal Property Assessment and RecordsAssessor - Real Estate Assessment and AppraisalAssessor - Real Estate Records.

For real property the market value is determined as of January 1 of the odd numbered years. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. Louis County Auditor 100 N.

May 15th - 1st Half Real Estate and Personal Property Taxes are due. Paying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official Payments Corp. Scott Shipman Assessor St.

The median property tax on a 17930000 house is 188265 in the United States. The median property tax in St. Sales Tax and Other Taxes.

October 15th - 2nd Half Real Estate and Personal Property Taxes are due. Cities and counties may impose an additional local use tax. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802.

A Post-Dispatch analysis of tax data shows that since 2010 the personal property tax has become a much more significant part of all taxes collected in St. What is Missouri tax rate. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes.

Leave this field blank. Your feedback was not sent. Place funds in for an inmate in the St.

County-wide reassessments take place every two years in odd numbered years. Locate print and download a copy of your marriage license. Pay your current or past real estate taxes online.

All Personal Property Tax payments are due by December 31st of each year. Louis County for example the average effective tax. You moved to Missouri from out-of-state.

You are in an active bankruptcy Form. The amount of use tax due on a transaction depends on the combined local and state use tax rate in effect at the Missouri location where the tangible personal property is stored used or consumed. Louis County please complete the New Resident Personal Property Declaration form.

2021 City of St Louis Tax Rate 6442 KB 2021 City of St Louis Merchants and Manufacturers Tax Rate 5798 KB 2021 City of St Louis Special Business District Tax Rates 70627 KB 2021 Historical Tax Rates for City of St Louis 6867 KB. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. The state use tax rate is 4225.

May 15th - 1st Half Real Estate and Personal Property Taxes are due. To declare your personal property declare online by April 1st or download the printable forms.

2022 Best Places To Live In The St Louis Area Niche

Missouri Has One Of The Highest Vehicle Property Tax Rates In The Nation Lake Of The Ozarks Politics Government Lakeexpo Com

Powered By Expert Realtors Creve Coeur Ladue Stl

Westchester Ny Vs Fairfield County Ct Westchester County Fairfield County Real Estate Tips

Collector Of Revenue St Louis County Website

16 Expert Realtors Expertrealtors Twitter First Time Home Buyers Realtors New Construction

Property Owners Housing Authority Of St Louis County

Your St Louis County Government St Louis County Website

Online Payments And Forms St Louis County Website

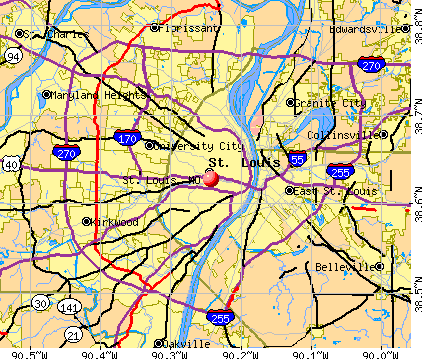

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

Revenue St Louis County Website

Revenue St Louis County Website

Action Plan For Walking And Biking St Louis County Website

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide